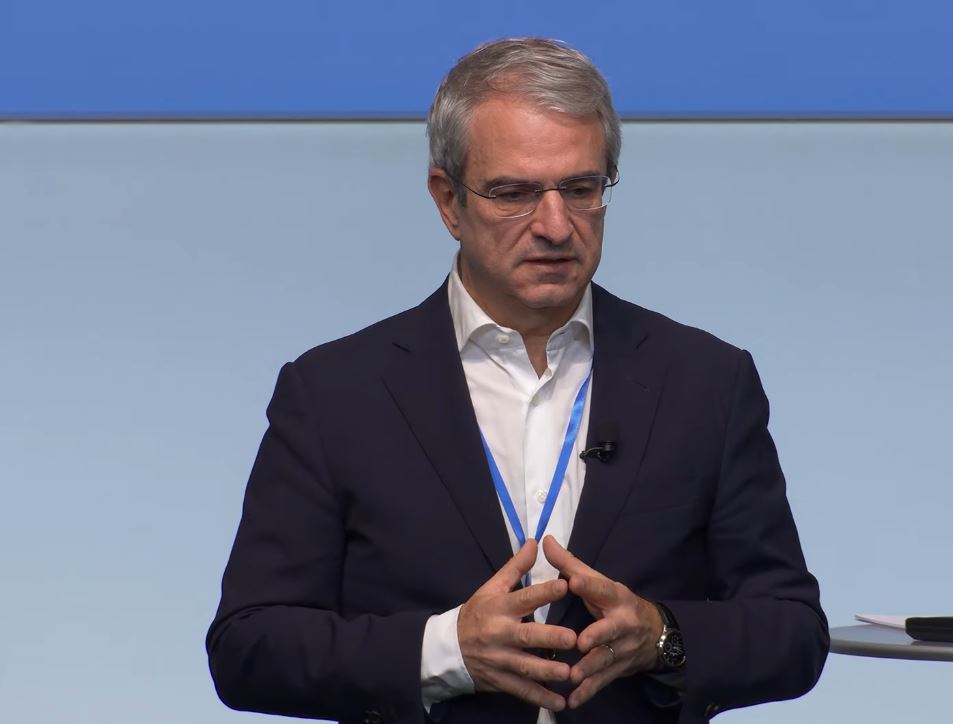

Laurent Freixe’s projected $4 million fortune in 2025 is the result of a career characterized by reliability, strategic judgment, and almost 40 years working for one of the most recognizable companies. However, his financial situation is now a subject of both interest and controversy due to the sudden termination of his leadership at Nestlé. His firing following an internal probe into an undisclosed relationship signaled a dramatic turn from stability to scandal, prompting many to reexamine his wealth and legacy.

His story feels especially noteworthy because the steady rhythm of corporate advancement, rather than high-risk endeavors or abrupt IPO surges, shaped his fortune. From Nestlé France in the mid-1980s to the Swiss executive suite, he was the quintessential devoted businessman. The foundation of his wealth was his stock holdings, which were worth roughly $3.6 million. The remainder was cushioned by years of executive salaries and bonuses. It is reminiscent in many ways of athletes who retired comfortably after seasons of consistent play but never pursued sponsorship glory.

| Detail | Information |

|---|---|

| Full Name | Laurent François Charles Freixe |

| Date of Birth | April 21, 1962 |

| Nationality | French |

| Education | EDHEC Business School, Lille; Executive Program at IMD, Switzerland |

| Career Start | Joined Nestlé France in 1986, focusing on sales and marketing |

| Major Roles | Nutrition Division Director (1999), Market Head Hungary (2003), Market Head Iberia (2007), EVP & CEO Zone Latin America (2022), CEO of Nestlé (Sept 2024 – Sept 2025) |

| Known For | Expanding Nestlé’s global reach, youth employment program “Nestlé Needs YOUth,” Nestlé CEO tenure |

| Net Worth (2025) | Estimated $4 million |

| Shares Held | More than 41,000 Nestlé shares, valued around $3.6 million in early 2025 |

| Controversy | Dismissed in 2025 after failing to disclose a relationship with a subordinate |

Given that “golden parachutes” frequently cushion even disgraced exits, the denial of a severance package upon his dismissal was exceptionally harsh for a CEO. The ruling demonstrated Nestlé’s unwavering commitment to upholding its governance standards. His wealth guarantees financial independence in spite of this. It demonstrates how, even when reputation wanes, decades of patient accumulation can continue to be remarkably effective in preserving stability.

In contrast to individuals such as Tim Cook or Elon Musk, Freixe’s wealth seems modest. However, his wealth is substantial within consumer goods corporations, where valuations grow steadily rather than explosively. It emphasizes how executives in traditional industries build their fortunes on dependability rather than the unpredictable volatility of tech stocks. The disparity also demonstrates how different people have different expectations about wealth: $4 million is a very long-lasting accomplishment for a veteran of the food industry.

Finance was not the only area affected by his dismissal. Nestlé’s prompt action was indicative of a corporate culture that is becoming less accepting of misconduct. Freixe’s fate is consistent with a larger societal trend: misconduct that was previously accepted in silence now has much more immediate repercussions. This is similar to how public figures like Andrew Cuomo or celebrities like Kevin Spacey saw their careers fall apart due to scrutiny. It reaffirmed the idea that accountability must be upheld at all levels for both shareholders and employees.

However, the legacy of Freixe cannot be quantified solely in monetary terms. His work on Nestlé Needs YOUth, which promoted opportunities for younger generations across regions, was especially innovative. These initiatives connect businesses and communities in ways that go beyond financial gains, having a noticeable social impact. These contributions continue to be a significant aspect of his professional identity, despite the scandal that has tainted his personal story. It reflects people like Bill Gates, whose charitable contributions are still acknowledged in spite of contentious discussions about company histories.

The erratic nature of leadership is further highlighted by this case. Nestlé lost two of its CEOs in less than two years: Mark Schneider and Freixe. Both employees and investors were reminded of how brittle leadership continuity can be, even in companies with a reputation for stability and longevity. However, Nestlé’s quick hiring of Philipp Navratil demonstrated how big organizations can frequently continue to be very effective at absorbing disruptions, guaranteeing that their plans go forward despite individual upheavals.

It is impossible to overstate the emotional toll that being fired from a company after almost 40 years of employment has taken on Freixe personally. His colleagues remember him as a very focused and efficient leader who prioritized clarity over flair. It must have been painful to lose the position so suddenly, without any formality or monetary farewell presents. However, the stability of his wealth acts as a buffer, enabling him to withdraw into financial security even when career opportunities become scarce.

His financial history provides a useful window into the creation, protection, and reinterpretation of executive wealth in the context of scandal. By celebrity culture standards, the $4 million sum is not remarkable, but it is a substantial accumulation of consistency, loyalty, and discipline over the course of a career. Freixe’s fortune shows that modest wealth combined with consistent professional performance can be just as instructive in a society where success is frequently determined by the loudest numbers.

In the end, Laurent Freixe’s net worth is more than just an approximate sum of money. It represents the paradox of security in the face of scandal: a wealth amassed through consistent corporate service that is now seen through the prism of moral dilemmas and lost chances. His tale serves as a powerful reminder that decisions, morals, and the sense of integrity all play a role in determining one’s fortune in addition to markets and earnings.